Card Grading Wars: The Rise, Fall & Future of PSA, Beckett, SGC & More

From PSA’s early dominance to today’s fragmented market — a deep dive into the past, present, and what’s next for card grading.

All Vintage Cards content is free. When you purchase through referral links on our site, we earn a commission. Learn more

Card grading is one of the most controversial—and essential—parts of the hobby. Love it or hate it, grading dictates trust, resale value, and even the headlines of record-breaking auction sales. But the journey to today’s grading landscape has been anything but smooth.

From PSA’s bold gamble in 1991 with the infamous Gretzky Wagner T206… to Beckett’s once-dominant slabs… to the “Junk Slab Era” of the COVID boom, grading companies have risen, collapsed, and battled for collector confidence.

Today, a handful of players—PSA, SGC, CGC, and a struggling Beckett—control most of the market, while smaller challengers and tech-driven startups try to crack the code. This is the story of the card grading wars: how we got here, who matters now, and what the future might hold.

Why Grading Matters

Card grading has become one of the most important aspects of the hobby, shaping both trust and value in the marketplace. At its core, grading verifies two things: the authenticity of the card and the accuracy of its condition. While grading can often feel subjective—and at times controversial—it remains essential, serving as the heartbeat of the modern card industry. Nearly all of the record-breaking auction sales in recent years have involved cards that were professionally graded.

AVC Acquisitions Portal

Sell Your Card Collection

Skip the listing process and long wait times. Get a professional offer on your collection within 48 hours. See our buy list.

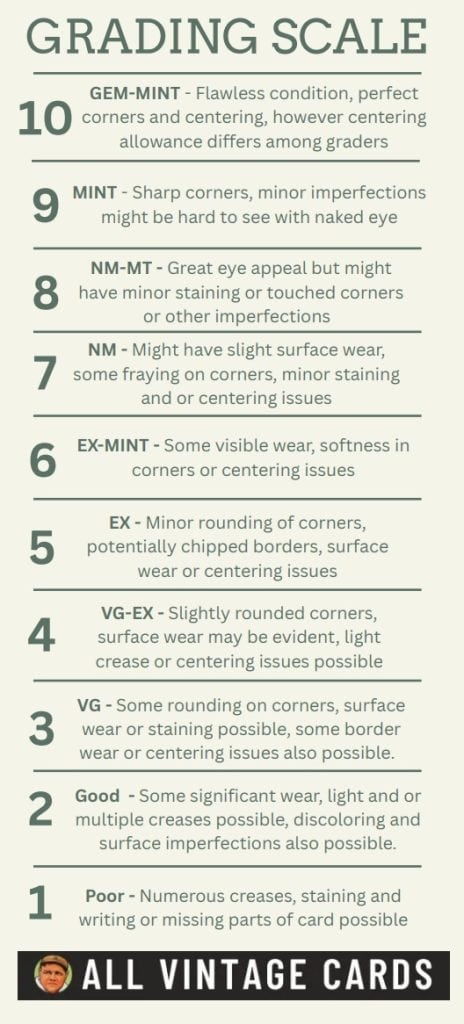

Grading companies use a numerical scale from 1 to 10, where even the smallest details can make a dramatic difference in value. The jump from a “9” to a “10” may hinge on the most subtle imperfections, yet that single grade bump can add thousands—or even hundreds of thousands—of dollars to a card’s price. Today, graders typically spend just 30 to 60 seconds evaluating and authenticating each card, with many handling 350–450 cards per day, sometimes more.

Collectors also have multiple grading options to choose from. Beyond the standard 1–10 scale, companies offer dual grading (separately evaluating the card and the autograph), “authentic” designations (verifying authenticity without assigning a number), and “auto-only” grades (evaluating only the autograph, not the card itself). For further detail, see the PSA and BGS sections below.

The Early Days Of Grading

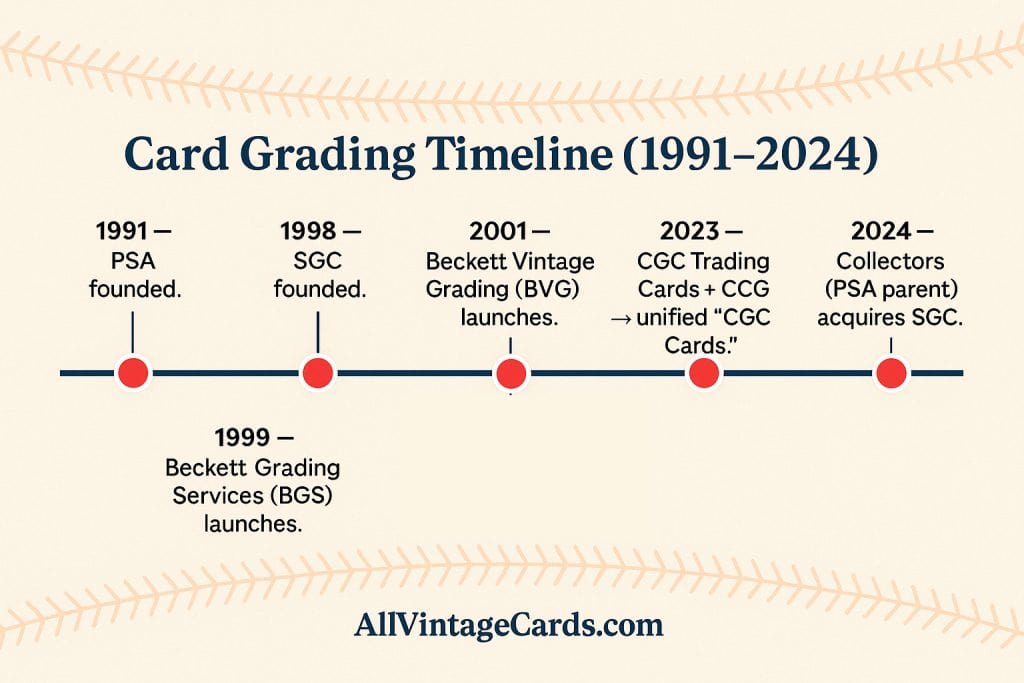

- 1991 — PSA founded.

- 1998 — SGC founded.

- 1999 — Beckett Grading Services (BGS) launches.

- 2001 — Beckett Vintage Grading (BVG) launches.

- 2023 — CGC Trading Cards + CSG → unified “CGC Cards.”

- 2024 — Collectors (PSA parent) acquires SGC.

PSA’s Launch (1991), Followed by SGC and Beckett

Professional Sports Authenticator (PSA) was founded in July 1991 as a division of Collectors Universe, itself linked to David Hall’s Professional Coin Grading Service (PCGS).

At the time, card grading was a new concept, and many collectors and dealers were skeptical of its value, questioning the idea of sealing cards in tamper-evident holders. Early adoption was modest, and throughout the 1990s PSA’s growth was steady but gradual.

From 1991 through 1998, the company had graded approximately one million cards. Today PSA grades roughly 1.5 Million cards per month.

The Gretzky Wagner PSA 8: The Card That Launched an Empire

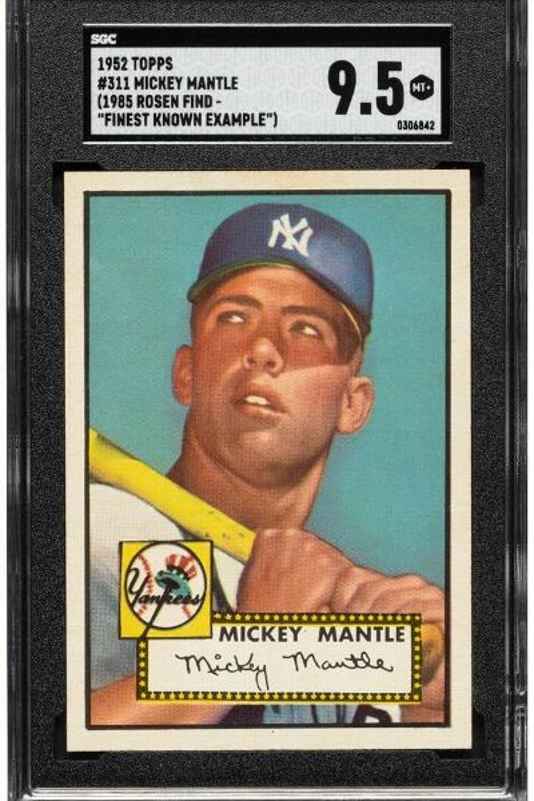

One of PSA’s earliest high-profile slabs was the T206 Honus Wagner once owned by Wayne Gretzky and Bruce McNall. The card received a grade of PSA 8, making it one of the hobby’s most publicized cards,with multimillion-dollar sales that boosted awareness of third-party grading. Its later sale prices in the millions brought additional visibility to PSA, though the card eventually became controversial after allegations that it had been trimmed before grading.

While the Gretzky Wagner is often cited as helping establish PSA’s reputation, most sources agree that the company’s broader acceptance in the hobby came more gradually, as collectors grew more comfortable with third-party grading in the late 1990s and early 2000s.

The T206 Wagner, later revealed to have been trimmed by notorious card doctor Bill Mastro, received a PSA 8 despite the alterations. PSA was well aware of the card’s issues but saw an opportunity: placing the card in a PSA slab would give them credibility and publicity that no marketing campaign could buy.

The gamble worked. The Gretzky Wagner became one of the first high-profile cards graded by PSA and helped propel the company into prominence. Today, that controversial PSA 8 Wagner—still listed in PSA’s population report—resides in the collection of Arizona Diamondbacks owner Ken Kendrick.

From PSA’s Beachhead to a Three-Horse Race (late 1990s)

As PSA slowly proved the third-party model through the 1990s, competition arrived. Sportscard Guaranty (SGC) opened in 1998, positioning itself as a vintage-first specialist with a distinctive black-insert (“tuxedo”) holder, while Beckett Grading Services (BGS) launched in 1999, leveraging Beckett’s magazine reach and introducing now-familiar features like sub-grades for centering, corners, edges, and surface. The late-’90s hobby surge (think the 1998 McGwire–Sosa home-run chase) and the rise of online marketplaces helped push graded cards further into the mainstream.

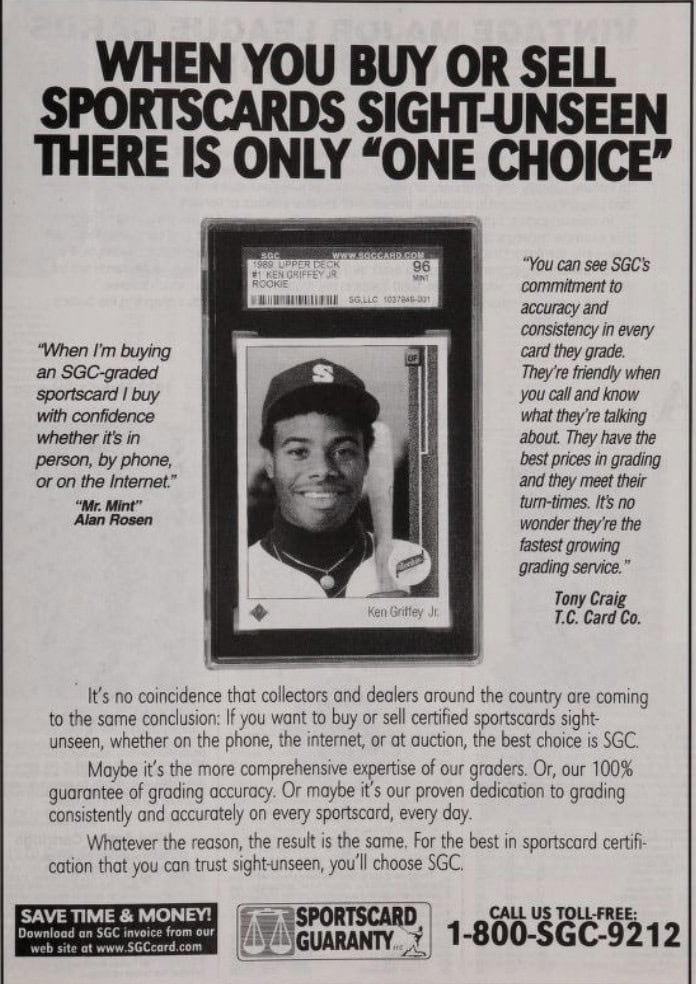

SGC (1998): Vintage-First Credibility

Founded in July 1998, SGC leaned into pre-war and classic post-war material, earning trust among vintage collectors who valued a consistent standard and the high-contrast “tuxedo” presentation. Early on, SGC even experimented with a 100-point scale before settling into today’s familiar 1–10 system. In past interviews, SGC leaders recalled how grading “absolutely exploded” in the late 1990s, as dealers adopted third-party holders.

“It just blew up,” said Dave Forman, who owns Sportscard Guaranty (SGC), about the sudden surge in grading. “I would say between ’95-’99, it absolutely exploded, where every dealer started using them. There was no eBay, and you go to shows and you’d see none of them. No graded cards. It just snowballed at that point.” – source SCD

Note that Collectors (PSA’s parent) acquired SGC in February 2024; both brands continue to operate separately under the Collectors umbrella.

Beckett Enters (1999): Sub-grades and the “Modern” Lane

Beckett Grading Services (BGS) launched in 1999, quickly differentiating with its four sub-grades (centering/corners/edges/surface) and the half-point scale (e.g., 9.5 Gem Mint). Beckett later added BVG (Beckett Vintage Grading) in 2001 to target pre-1981 cards, and also ran the lower-cost BCCG line for a time (now discontinued). Beckett’s arrival cemented grading as a three-player market through the 2000s.

The Original Role of Grading (Primarily for Vintage)

In its earliest years, grading was marketed as a safeguard against trimming, alteration, and forgery—issues that plagued vintage cards in particular. Encapsulation brought a new level of stability and trust to the market. Instead of collectors struggling to compare raw cards against each other, graded examples provided a more consistent benchmark. This shift laid the groundwork for grading to become central to the modern hobby.

Early Promotion and Hobby Awareness

Grading gained visibility through hobby media—especially Beckett magazines—which dominated the 1990s with price guides, show coverage, and ads that familiarized collectors with PSA and SGC. After Beckett Grading Services launched in 1999, Beckett publications began running BGS submission forms, further normalizing the process.

Boom & Bust (2020–2022): The “Junk Slab” Era

The COVID-19 pandemic sparked an unprecedented surge in the sports card market, and grading companies were pushed to their breaking point. Submissions skyrocketed to all-time highs, and some collectors waited more than a year to get their cards back. The backlog was so massive that even today, certain companies are still feeling the ripple effects.

This grading “gold rush” also opened the door for a wave of new entrants—firms promising faster turnaround times, cheaper pricing, and innovation. Most, however, couldn’t sustain momentum once the industry normalized. Collectors often call this stretch the “Junk Slab Era”—a reference to the flood of base cards graded during the boom that now hold little long-term value. Let’s break down the winners, losers, and lessons from this defining period.

PSA

PSA bore the brunt of demand and reaped the biggest reward. Even as queues stretched to 12–18 months and lower-cost tiers were temporarily paused, submitters kept sending cards because PSA slabs delivered the strongest resale and registry ecosystem.

PSA leaned into brand reach, including high-visibility partnerships (such as with Mike Trout) and heavy auction presence kept PSA top-of-mind while cards were still in the mail.

Result: PSA exited the boom with a larger lead in both volume and resale premiums, despite enduring the harshest public scrutiny for delays and upcharges.

To combat the surge in volume, PSA expanded facilities, added automation/AI-assist for intake and prescreen workflows, and reopened tiers in phases. In addition, PSA implemented dynamic turnaround tiers (bulk/value up to premium) that let impatient customers pay for speed.

BGS (Beckett Grading Services)

If PSA thrived, Beckett stumbled. Prior to COVID, BGS was a co-leader in the market, with values on many cards rivaling PSA’s. But their pandemic-era pricing misstep proved devastating: for nearly 18 months, the cheapest grading option at BGS was $125 per card. Collectors bolted, many never returning.

Today, according to GemRate data, BGS consistently ranks fourth or fifth in monthly submission totals, far behind PSA, SGC, and CGC. The only factor keeping Beckett in the conversation is its elusive BGS 10 Black Label, which remains one of the most coveted slabs in the hobby—with a gem rate of just 0.1%.

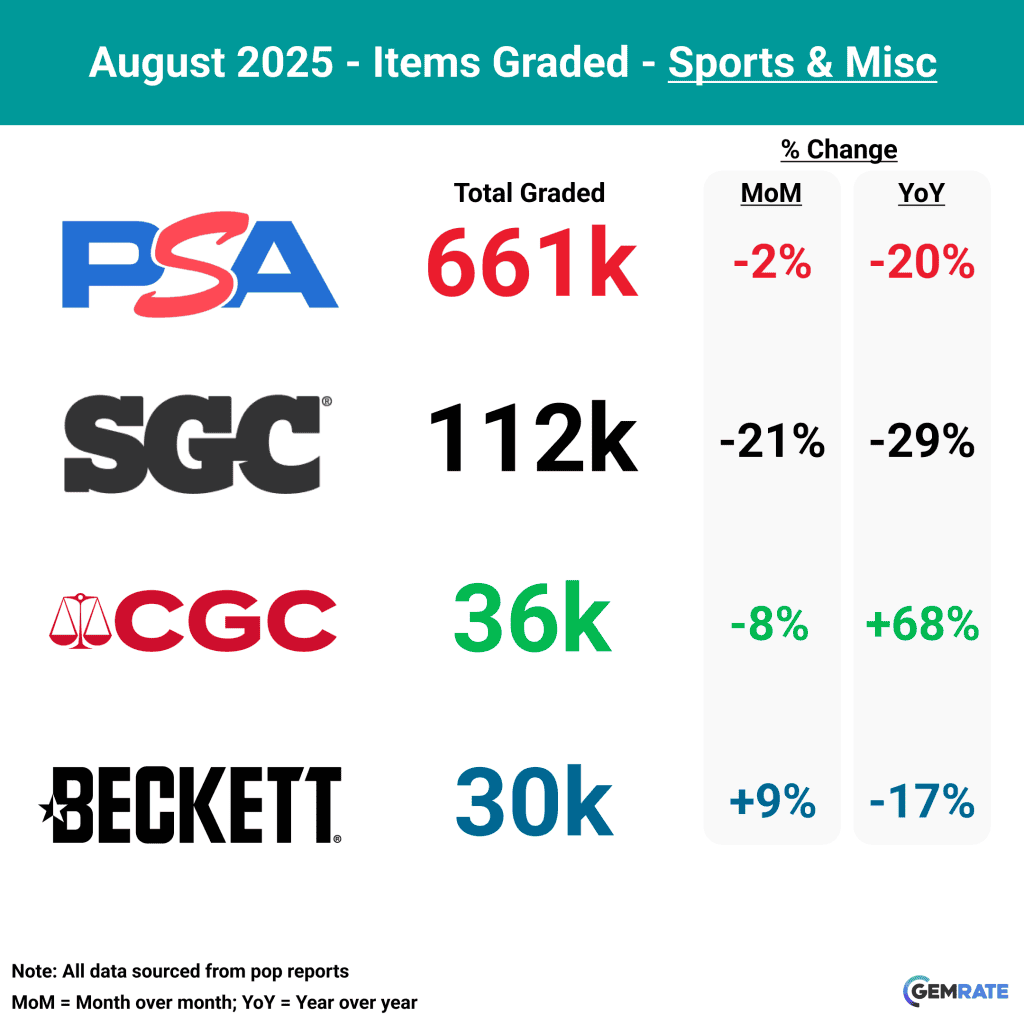

SGC

Long a vintage specialist, SGC seized the moment with reliable, fast turnarounds and simple pricing when others were log-jammed. That operational consistency did three things:

Built trust: clear communication and predictable SLAs turned a COVID-era stopgap into lasting share.

SGC emerged from the boom as a durable No. 2/3 option and a credible alternative for both vintage and modern.

Captured modern flow that wouldn’t wait for PSA’s timelines, raising the profile of the “tuxedo” holder across ultra-modern sets.

Narrowed comps: while PSA still commands the highest multiples on many modern issues, SGC closed the gap in several categories and reinforced its leadership in vintage.

Today, SGC, now owned by Collectors (parent of PSA) remains the #2 player in sports grading, well ahead of CSG and Beckett but well behind the leader PSA

HGA (Hybrid Grading Approach)

HGA burst onto the scene during the pandemic with bold promises: computer-assisted grading, affordable pricing, and customizable, team-colored labels. Collectors were intrigued, and submissions poured in.

But once PSA and SGC caught up on turnaround times, HGA’s novelty faded. Operational struggles mounted, and the company eventually stopped taking submissions. Today, HGA is looking for a partner to help them relaunch, but their brief flash of popularity feels very much like a product of the COVID boom. It likely won’t be long before they are added to the Sports Card Grading Graveyard.

TAG

Unlike HGA, TAG had been in development for nearly a decade before launching during the pandemic. Their pitch was simple but compelling: precision computer grading and transparency. TAG slabs came with a detailed grading report, outlining exactly why a card received its final grade—an innovation many collectors still praise.

While TAG hasn’t yet cracked into the top tier, their technology-driven approach could influence the future. Don’t be surprised if PSA or SGC eventually roll out their own versions of digital grading summaries.

CGC (now known as CSG)

CGC, long established as a leader in comic grading, expanded aggressively into trading cards during the pandemic. Their slabs gained traction particularly in non-sports categories—Pokémon, Magic: The Gathering, and Yu-Gi-Oh—where collectors were eager for an alternative to PSA’s long wait times.

CGC’s reputation and infrastructure gave them credibility, and by the end of the boom, they had established themselves as a legitimate player in the sports and TCG grading space. However, recent trends show CGC’s traction in sports grading hasn’t quite materialized; per month, they are grading about the same volume in Sports as Beckett Grading.

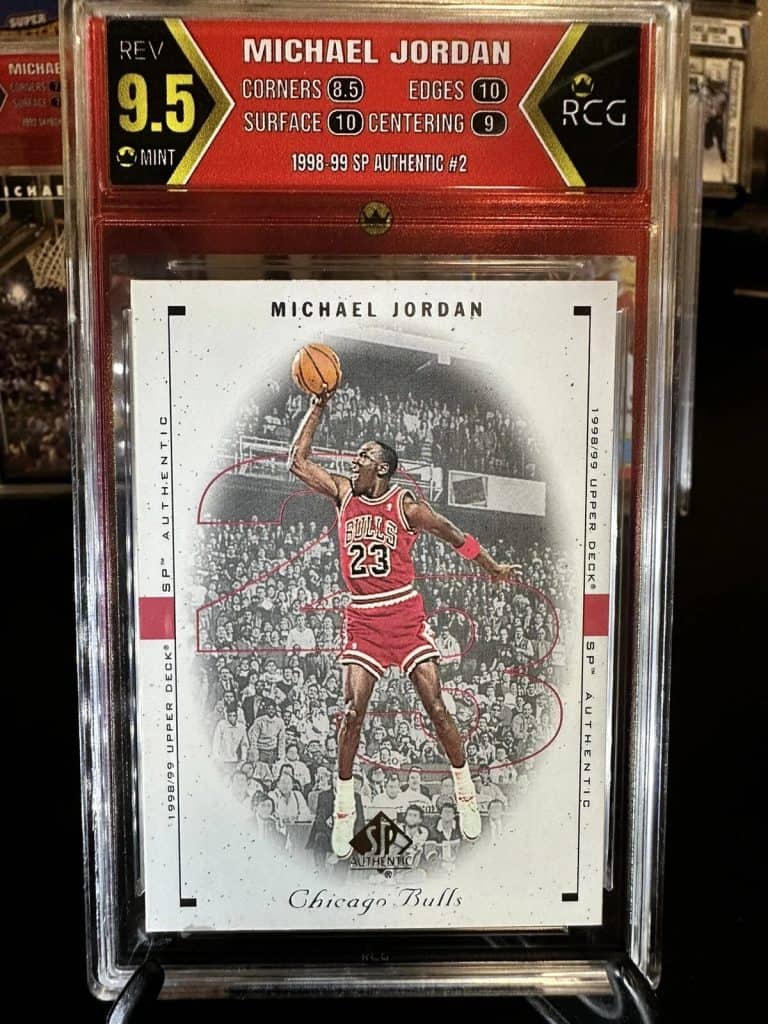

RCG

Similar in concept to HGA (kinda like an HGA knock-off), RCG offered colorful, themed holders and managed to carve out a tiny niche during the boom. However, many reports about RCG (Revolution Card Grading) were not flattering, and I’m not even sure they are still grading cards any longer.

Lessons from the COVID Era

- Explosive demand created opportunities but also exposed weaknesses.

- PSA solidified its dominance, while Beckett fell sharply behind.

- New entrants (HGA, TAG, RCG) had brief moments but struggled with long-term sustainability.

- TAG’s detailed tech oriented grading reports are excellent, and I hope if they don’t survive one of the big grading companies implements a similar grading report.

- SGC gained real traction, expanding their role in the hobby.

- Junk Slab overhang: not every card is worth slabbing.

The COVID-era boom reshaped the grading landscape, creating winners, losers, and cautionary tales that still echo in today’s hobby.

Today’s Landscape (2025)

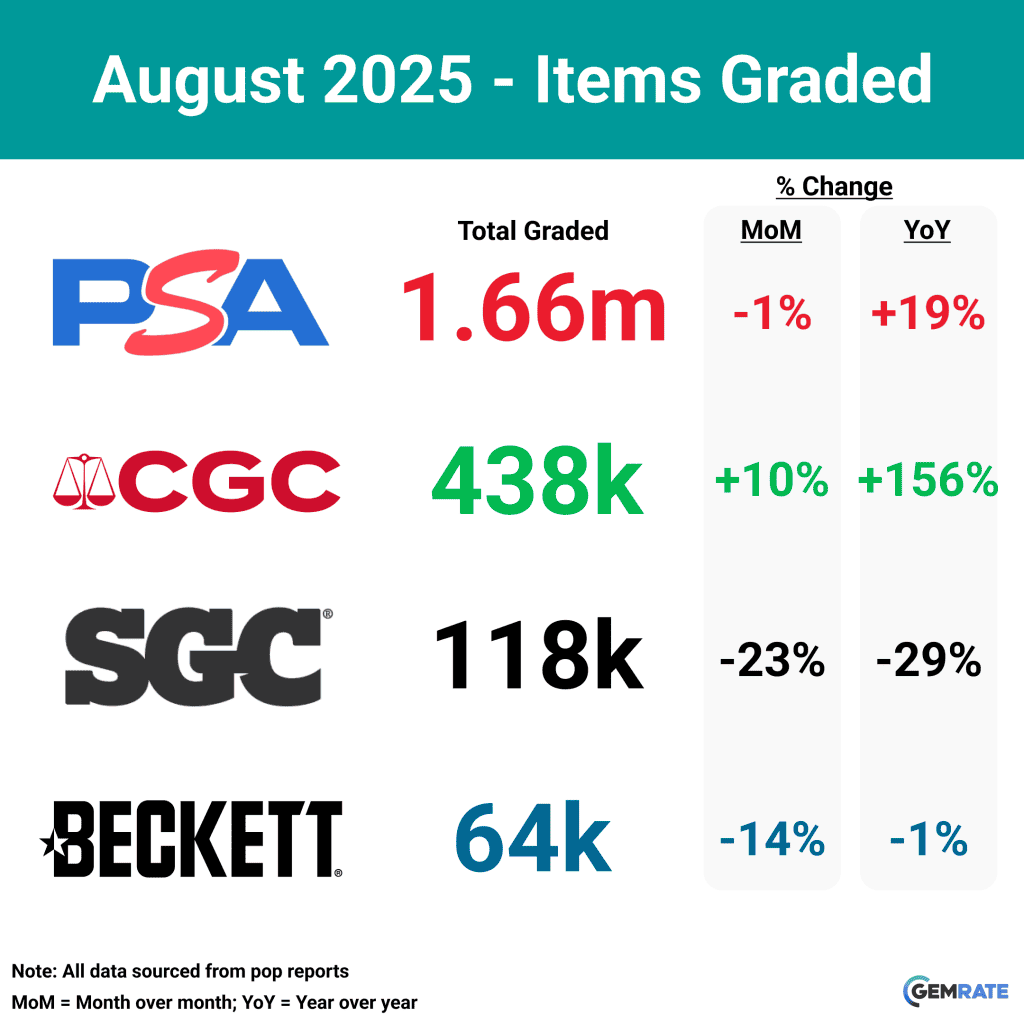

The grading industry has settled into a new hierarchy. While dozens of companies have tried to carve out space, only a handful matter when it comes to submission volume, resale value, and brand trust. Below is a scorecard of the top players in 2025, followed by a detailed breakdown of each.

| Company | Launch Year | Specialties | Resale Value Strength | Notable Innovations |

|---|---|---|---|---|

| PSA | 1991 | All sports, registry, auctions | ★★★★★ (Strongest) | Lighthouse labels, PSA Registry, eBay consignment, instant cash-out offers |

| SGC | 1998 | Vintage, growing modern base | ★★★★☆ | “Tuxedo” slab design, strong COVID turnaround times. Now part of Collectors (PSA parent); operates separately. |

| CGC | 2020 (cards division). They are leader in comic books as well. | TCGs (Pokémon, MTG, Yu-Gi-Oh), sports and non-sports. | ★★★☆☆ | Affordable, fast, Perfect 10 (black label equivalent). |

| BGS (Beckett) | 1999 | Modern cards, dual grades | ★★★☆☆ (declining) | Sub-grades, Black Label 10, “True Gem” terminology |

| Arena Club | 2023 | Vaulting + marketplace features | ★★☆☆☆ | Derek Jeter-backed, digital-first vaulting model |

| TAG | 2010 (launched late 2020s) | Tech-driven grading | ★★☆☆☆ | Full grading report w/ computer precision |

| HGA | 2021 | Custom label colors | ★☆☆☆☆ (inactive) | Computer-assisted grading + team-color slabs |

| GMA | Early 2000s | Low-cost grading | ★☆☆☆☆ | Cheapest slabs, but little resale premium |

| ISA | 2010 | Small-scale, alt. slabs | ★☆☆☆☆ | Occasional crossovers, minimal hobby impact |

Emerging & Niche Players

Arena Club

Launched in 2023 with backing from Derek Jeter, Arena Club blends grading with a vault + digital marketplace. Collectors can buy, sell, or vault cards directly on the platform. While their slabs haven’t yet achieved strong resale traction, their tech-driven model may appeal to younger collectors and investors. Their focus on infrastructure over grading itself makes them one to watch, but they remain a secondary choice for most in 2025.

GMA

Operating for over 20 years, GMA is known as a budget grader. With prices around $18–20 per card, they’re only slightly cheaper than SGC or CGC, yet resale premiums are far lower. Most collectors treat GMA slabs like raw cards, though they still appeal to casual sellers looking for inexpensive encapsulation.

ISA (International Sports Authentication)

Founded in 2010, ISA serves as another small-scale alternative. Their slabs occasionally cross over to PSA or SGC, but the company has little market share. Big cards rarely appear in ISA holders, and resale values tend to hover just above raw prices.

Others (RCG, AGS, etc.)

Companies like RCG (color-matched holders) and AGS (AI-based grading) have loyal niche followings but minimal resale presence. For most collectors, these are curiosity slabs—interesting to see, but not trusted enough to drive value.

What Collectors Value Most in 2025

Card collectors all have a different taste in which grading company they prefer and why. Some collectors want to add the most value to their cards regardless of the cost or time to grade them, while others want their cards back as quickly as possible just to have their cards slabbed. There are definitely pros and cons when deciding which grading company to choose from plus the turnaround time and cost. PSA has the advantage of being able to add your graded cards to the PSA registry and compare your collection to other collectors.

- Market perception of each brand (based on data, but also hobby forums, auction comps, etc.).

- Trust, consistency, turnaround, customer service.

The Future of Card Grading

Where does grading go from here? While PSA continues to dominate, the future may bring shifts in both technology and consolidation.

AI & Computer-Assisted Grading

Several companies (TAG, HGA, AGS and PSA) have experimented with AI or computer-aided grading, offering detailed breakdowns and consistency that humans sometimes lack. While intriguing, these systems haven’t yet scaled to PSA-level trust. Collectors still prefer the “human touch,” especially for subjective calls on centering, print quality, and surface flaws. That said, AI could become a supplement rather than a replacement—used to double-check or standardize human graders.

As show in the video below, Nat Turner explains how PSA is using AI tools to automate centering grades.

Blockchain & Transparency

Another area with potential is blockchain-backed grading. Imagine slabs with embedded chips tied to a blockchain ledger, recording provenance, ownership, and grade history. This could reduce fraud and improve trust in POP reports. A few startups have hinted at this, but no major grading company has executed it at scale.

Consolidation & Survivability

History tells us not every grading company survives. Just as dozens of smaller firms faded in the early 2000s, we’re likely to see attrition again. Companies like PSA, SGC, and CGC have the infrastructure, trust, and submission flow to weather cycles, while niche players may struggle or be acquired.

The “Next PSA”?

Could another company ever rival PSA? It’s unlikely without a seismic shift. The only path would be a firm that combines innovative slab design, transparent grading reports, and strategic partnerships (eBay, Fanatics, or a major athlete/investor). Even then, it would take years to build the trust PSA enjoys today. More realistically, PSA’s dominance will continue, with SGC and CGC holding strong secondary roles.

Final Thoughts

Card grading remains one of the most debated and polarizing topics in the hobby. It’s inherently subjective—what one grader calls a “Gem Mint 10” another may mark as a 9. Rumors of preferential treatment, inconsistent standards, and altered cards slipping through the cracks only add fuel to the controversy. While technology could help reduce errors and detect alterations, the human element still drives the process, for better or worse.

Yet despite its flaws, grading adds tremendous value to the hobby. It provides trust, standardization, and liquidity—turning raw cardboard into assets that collectively generate millions in sales each day. Without grading, the modern card market as we know it simply wouldn’t exist.

Why Collectors Should Care

Grading isn’t just about slabbing cards; it’s about protecting investments, ensuring authenticity, and creating transparency in a fast-moving marketplace. Whether you’re chasing vintage Hall of Famers, modern rookie autos, or Pokémon cards, choosing the right grader can significantly impact both resale value and long-term collectability.

Tips for Choosing the Right Grader (2025)

On a Budget: Companies like GMA or ISA offer cheaper slabs, but resale premiums are weak—there really is no other choice aside from PSA or SGC.

For Maximum Resale Value: PSA is still king, especially for modern rookies and high-dollar vintage. Expect to pay more and wait longer, but resale strength is unmatched.

For Vintage Collectors: SGC continues to be a strong choice, with slabs that present well for older cards and improving resale momentum.

For Non-Sports (Pokémon, TCGs): CGC dominates this space with quick turnaround times and solid market recognition.

For Niche or Experimentation: TAG’s detailed grading reports are appealing for transparency, though resale is limited. Arena Club’s vaulting model may interest tech-savvy collectors.