Smart Money: The 2026 Vintage Baseball Card Strategy

All Vintage Cards content is free. When you purchase through referral links on our site, we earn a commission. Learn more

The vintage baseball card market in 2026 is no longer just a hobby—it’s a disciplined asset class. While modern “ultra-modern” cards fluctuate with every box score, vintage remains a resilient hedge against market volatility. We are currently seeing record highs across various auction houses, but the “smart money” isn’t just buying everything; it is strategically consolidating into eye appeal, scarcity, and undervalued Hall of Fame legacy.

Here is the trend-based analysis of where serious collectors are quietly positioning their capital.

The Flight to “Blue Chip” Icons

The “Blue Chip” icons of vintage baseball—legends like Mickey Mantle, Willie Mays, Jackie Robinson, and Babe Ruth—remain the safest harbor for hobby capital.

Through 2025 and into 2026, I expect the trend to continue: serious collectors are moving away from owning “volume” and instead consolidating their collections. This means selling off 20 or 30 mid-tier cards to put that money into one high-end, iconic card that is easier to track, store, and eventually liquidate. I also expect further realization among modern collectors that vintage remains the place to be, especially for serious investors.

AVC Acquisitions Portal

Sell Your Card Collection

Skip the listing process and long wait times. Get a professional offer on your collection within 48 hours. See our buy list.

While high-grade examples of these players continued to shatter records in 2025, the reality is that less than 1% of the population can afford a PSA 8 or 9 Mantle. However, this “high-end buzz” is a positive for everyone; it creates a “halo effect” that makes even lower-grade vintage a smarter investment.

Smart Money Tip: The “Non-Rookie” Alternative

If you are priced out of a player’s rookie card, the smart move is to target their undervalued non-rookie years. You can often find a card with incredible “eye appeal” from a legend’s playing days for a fraction of their rookie price.

- The Mickey Mantle Example: While his 1951 Bowman and 1952 Topps cards are the “holy grails,” his 1956 Topps card is a perfect example of secondary growth. A PSA 4 example was valued around $2,000 in 2024 and reached as high as $2,800 in 2025—a steady climb that proves Mantle is one of the most liquid assets in the hobby.

- The Jackie Robinson Play: Jackie’s cards are becoming increasingly “sticky” (hard to find) in all grades. Don’t just chase the rookie; his other cards from the mid-1950s have plenty of room to grow as historical significance continues to drive demand.

- The Koufax Value: As one of the greatest living Hall of Famers, Sandy Koufax’s cards across all years and grades are bound to see continued appreciation.

The Bottom Line: If you want to invest in a legend, buy the highest grade you can afford, but don’t be afraid to consider 2nd-, 3rd-, or 4th-year cards. These are the “hidden gems” where the smart money is quietly moving right now.

Comparison: Rookie vs. Undervalued “Icon” Years

| Player | Rookie Card (Typical Focus) | Smart Money “Value” Year |

| Mickey Mantle | 1951 Bowman / 1952 Topps | 1956 Topps (Iconic horizontal design) |

| Hank Aaron | 1954 Topps | 1957 Topps (Only card with him batting lefty) |

| Jackie Robinson | 1948 Leaf / 1949 Bowman | 1953 Topps (High aesthetic appeal) |

| Willie Mays | 1951 Bowman | 1954 Topps (Vibrant colors, more affordable) |

Targeting the “Hall of Fame Gap”

There is a massive value gap between the “Elite” (Mantle/Mays) and “Core” Hall of Famers. Sophisticated investors are targeting HOFers whose cards are significantly rarer than their current prices suggest.

- Whitey Ford: His 1951 Bowman rookie sits in the shadow of Mantle’s rookie from the same year. A well-centered PSA 3 at $500 is a steal given the historical significance of the “Chairman of the Board.”

- Warren Spahn: As the winningest left-hander in history, Spahn’s 1948 Bowman rookie (PSA 3 at ~$250) represents one of the best “floor” investments in the 1948 set—a cornerstone of any vintage portfolio.

- Joe Morgan: Often cited as the greatest second baseman of all time, his 1965 Topps rookie card in a PSA 8 grade has seen recent spikes to $1,400. This indicates that the market is finally correcting for players with elite advanced metrics (WAR).

Speculating on Future Inductees

The 2026 Contemporary Baseball Era ballot has created a new wave of “pre-induction” buying. Smart money moves before the announcement.

- Lou Whitaker: With one of the highest WARs for a second baseman not in Cooperstown, his 1978 Topps rookie (PSA 9 at ~$220) is a prime candidate to double upon induction. Although he was left off this years contemporary ballot, I expect Whitaker to reach the HOF within a few years.

- Bruce Bochy: His managerial success makes him a lock. His 1979 Topps rookie is a “low pop” (Population Report) target in high grade, with only about 300 PSA 9s in existence. This isn’t a 10x-return kind of play, but it could easily increase by 50% upon election.

- Dwight Evans: Following the trend of Dave Parker’s recent surges, “Dewey” is the next logical veteran committee pick. His 1973 Topps rookie remains undervalued relative to his Gold Glove legacy.

Signed & Slabbed Rookie Autos: The New “Vintage One-of-One”

While collectors have chased high-grade base cards for decades, the Signed/Slabbed Vintage Rookie is the market’s best-kept secret. Unlike modern cards with thousands of “on-card” autographs, a 1950s or 60s rookie card signed during the player’s lifetime is a unique piece of history.

Why They Are Undervalued

The value lies in the Dual Grade—the combination of the card’s technical condition and the quality of the autograph (e.g., PSA 8 Card / PSA 10 Auto). Because many vintage players have passed away, the supply of these signed rookies is permanently capped. They are effectively the “accidental one-of-ones” of the vintage era.

Real-World Market Growth

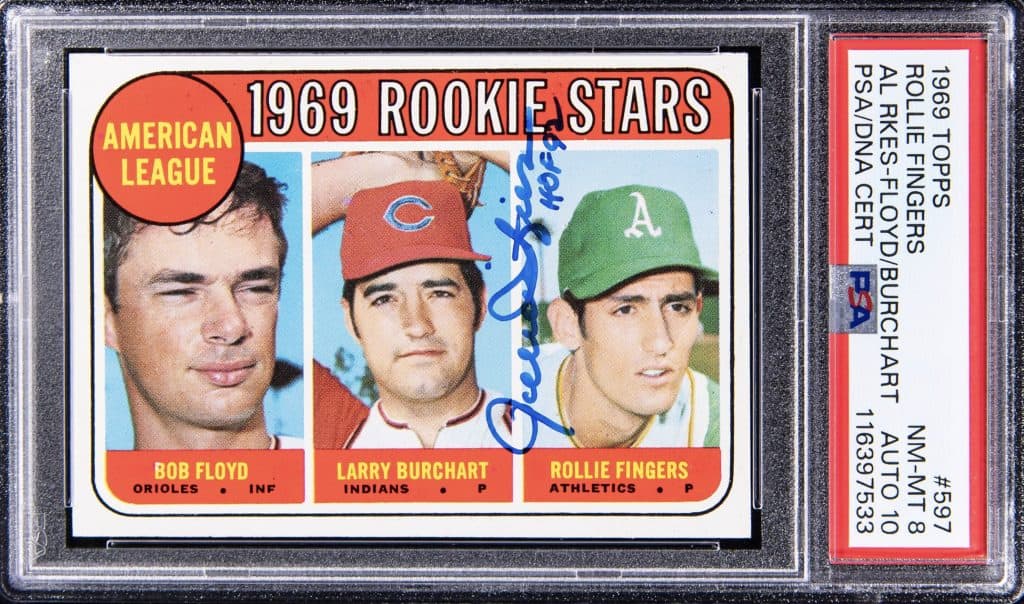

I recently tracked this trend with a 1969 Topps Rollie Fingers Rookie.

- The Buy: I won a PSA 8 card with a PSA 10 Autograph on Goldin Auctions for $400.

- The Sale: Within just a few months, I sold it on eBay for $580.

- The Lesson: This 45% return reflects a significant supply-and-demand factor. Investors seeking “low-pop” (low-population) assets are looking for these dual-grade slabs because they are significantly harder to find than unsigned versions.

🔍 Pro Tip: How to Find the “Real” Pop Report

To accurately assess the scarcity of a signed vintage card, a standard search isn’t sufficient. You must look for the Dual Service population:

Navigate to the PSA Pop Report page here: https://www.psacard.com/pop

Search the player’s name + the card year.

Compare the number of “Signed” examples to the total graded population.

You will often find that while 5,000 copies of a card exist, only 50 or 60 exist with a certified autograph.

That is your scarcity.

The video below shows how to view the PSA pop report for both regular cards and PSA/DNA-graded auto copies.

Buy The Card, Not The Grade

In the modern card market, a PSA 10 is the only goal. But in vintage, two cards with the exact same numerical grade can have vastly different values. The “Smart Money” ignores the number on the slab and looks for eye appeal, keying in on centering, registration, and colors that pop. Those who are good at this can ultimately crossover undergraded cards, making a handsome profit.

- A Centering Premium: A vintage card with a perfectly centered image (50/50) adds a massive premium. For example, a PSA 4 with perfect centering often looks more attractive—and sells for more—than a PSA 6 that is tilted or off-center.

- “Technical Flaw” Strategy: Savvy investors look for cards with high “Eye Appeal” that were graded lower due to invisible flaws. A card might have a small mark on the back or a tiny pinhole that drops it to a PSA 3, but if the front is perfectly centered with vibrant colors, it will trade like a much higher-grade asset.

- Why it matters: Centering is the first thing a buyer sees. When you eventually sell your investment, a well-centered “mid-grade” card will always attract more buyers than a poorly centered “high-grade” card.

Top Platforms for Sourcing Vintage in 2026

Unlike modern cards with “manufactured scarcity” (like 1/1 parallels), vintage scarcity is accidental. These cards weren’t meant to be saved; they survived by chance. This makes finding high-quality examples a “treasure hunt” that requires looking across multiple platforms.

Because “Blue Chip” cards don’t appear for sale every day, you need to widen your net. If you are targeting a specific Hall of Famer, the smart play is to monitor both the major auction houses and the “community” groups.

| Platform Type | Best For | Examples |

| Premier Auctions | High-end “Grails” & Authenticity | Heritage, Goldin, Robert Edward Auctions (REA) |

| Specialized Vintage | Mid-Grade & Set Filling | Greg Morris Cards, Memory Lane, Mile High Card Co. |

| Marketplaces | Daily Deals & Liquidity | eBay, MySlabs, Fanatics Collect |

| Community Groups | Direct Buying (No Fees) | Facebook Vintage Baseball Groups, Local Card Shows |